EV market statistics

Published November 26, 2025

- The UK’s new car market rose 0.5% in October 2025 to 144,948 units, as BEVs captured a 25.4% share with 36,830 registrations.

- This was the second-highest recorded market share for BEVs in 2025 so far, although still fell short of the 28% target set by the Government’s ZEV mandate.

- Electrified car sales (BEV, PHEV, and HEVs) comprised over half the total registrations for the second month running, achieving a combined 50.8% market share.

Our updated EV market guide is a valuable resource for automotive journalists, industry professionals, and consumers alike. It features the latest statistics, data, and expert insights to help you understand the key trends shaping the UK’s electric car market.

Glossary of EV terms

YoY: Year-on-year

Powertrain: This is the system responsible for generating a vehicle’s power - and transferring it to the road.

Market share: In the context of these guides, ‘market share’ refers to the share of cars sold over a specified period, rather than share of the overall car parc.

EV: Electric vehicle

BEV: Battery electric vehicle

PHEV: Plug-in hybrid electric vehicle

MHEV: Mild hybrid electric vehicle

ZEV: Zero emission vehicle

SMMT: Society of Motor Manufacturers and Traders

Get a free valuation

The current state of the new EV market

| Powertrain | Oct 2025 | Oct 2024 | % change (YoY) | Market share ‘25 | Market share ‘24 |

|---|---|---|---|---|---|

| BEV | 36,830 | 29,802 | +23.6% | 25.4% | 20.7% |

| PHEV | 17,601 | 13,832 | +27.2% | 12.1% | 9.6% |

| HEV | 19,250 | 18,862 | +2.2% | 13.3% | 13.1% |

| Petrol | 64,360 | 72,831 | -11.6% | 44.4% | 50.5% |

| Diesel | 6,907 | 8,961 | -22.9% | 4.8% | 6.2% |

| Total | 144,948 | 144,288 | +0.5% |

Source: SMMT

Please note: Mild hybrid electric vehicle (MHEV) registrations are included in the petrol and diesel figures.

Year-to-date analysis: Jan-Oct 2024 and 2025

| Powertrain | Jan-Oct 2025 | Jan-Oct 2024 | % change (YoY) | Market share ‘25 | Market share ‘24 |

|---|---|---|---|---|---|

| BEV | 386,244 | 299,733 | +28.9% | 22.4% | 18.1% |

| PHEV | 190,240 | 138,775 | +37.1% | 11.0% | 8.4% |

| HEV | 241,919 | 223,908 | +8.0% | 14.0% | 13.5% |

| Petrol | 814,154 | 889,356 | -8.5% | 47.2% | 53.6% |

| Diesel | 90,563 | 106,610 | -15.1% | 5.3% | 6.4% |

| TOTAL | 1,723,120 | 1,658,382 | +3.9% |

Source: SMMT

- Between January to October 2025, registrations for BEVs and PHEVs grew by 28.9% and 37.1% YoY respectively.

- Market share for BEVs increased to 22.4% (up 4.3% YoY), while PHEV market share rose to 11.0% (up 2.6% YoY).

- HEVs also recorded growth, with registrations up 8.0% YoY and market share growing to 14.0% (a 0.5% increase).

- In contrast, petrol registrations fell by 8.5% YoY, with market share dropping to 47.2% (down 6.4% YoY).

- Diesel saw a sharper decline, with registrations down 15.1% YoY and market share falling to 5.3% (down 1.1% YoY).

webuyanycar’s head of technical services, Richard Evans said:

“The shift towards an electrified road network is continuing at pace, with EVs and plug-in hybrids showing strong growth while petrol and diesel registrations continue to decline.”

“This trend underscores the market’s rapid transition toward low- and zero-emission motoring, with nearly new electric vehicles playing an increasingly important role in meeting consumer demand.”

“With 135+ new EVs to choose from - and attractive electric car grants and manufacturer discounts now available with many models, there’s plenty to entice more drivers to make the switch over the coming months.”

Discounts for new EV buyers through the Electric Car Grant scheme

- The UK Government’s Electric Car Grant scheme was introduced in July 2025 to make EVs more affordable and encourage widespread adoption.

- The £650 million scheme offers discounts of up to £3,750 on selected new electric cars priced at £37,000 (with some variants of eligible models priced up to £42,000 also qualifying).

- As of November 2025, there are over 40 eligible models, although only three qualify for the maximum grant: the Citroen e-C5 Aircross, Ford Puma Gen-E, and Ford E-Tourneo Courier).

- This scheme replaces the original Plug-in Car Grant (PICG), which ran from January 2011 to June 2022, and offered discounts to private and fleet EV buyers.

Budget statement 2025: What does it mean for EVs?

On November 26th, 2025, Chancellor Rachel Reeves confirmed the following tax changes for electric cars in her Budget announcement:

New per-mile tax for EVs and PHEVs from 2028

An additional mileage-based tax for BEVs and PHEVs will start from April 2028. The charges for the 2028/29 tax year are as follows:

- A 3p per mile tax for BEVs. (This equates to around half the fuel duty rate paid by petrol drivers.)

- A lower 1.5p per mile tax will apply to PHEVs.

- The cost per mile will increase each year in line with inflation (CPI).

- An average BEV driver travelling 8,500 miles in 2028/29 will pay an extra £255 in tax.

Increased expensive car supplement threshold

The expensive car supplement (ECS) is an additional annual tax, which is currently levied on all cars with a list price of £40,000 or more, including EVs.

It is applied from the second to sixth years of tax registration.

From April 1st 2026, the ECS list price threshold for BEVs will rise from £40,000 to £50,000.

- The ECS will amount to £2,370 in additional tax for a new car bought in the 2025/26 tax year, at an average cost of £474 a year over five years.

- The threshold increase will exclude many new mid-range EVs from the ECS, helping to make electric motoring more affordable to consumers.

Used electric car sales Q3 2025

A strong quarter for used electrified sales

- In Q3 2025, used BEV sales grew by 44.4%, faster than any other powertrain, with 80,614 transactions, securing a 4.0% market share.

- HEV sales grew by 30.0% with 107,727 transactions, achieving a market share of 5.3% - and PHEV sales grew by 2.0% to 23,480 transactions, reaching a 1.2% market share.

ECOS driving used EV sales but under threat

- 99,313 cars under one year old, a third of which were electrified (BEVs, PHEVs, and HEVs), changed hands in Q3.

- Employee car ownership schemes (ECOS) supplied many nearly new, low- and zero-emission vehicles to the used market.

- However, the SMMT has highlighted that potential Government plans to remove this scheme could cut new registrations by around 80,000 units per year, risking consumer choice, affordability, and access to sustainable cars.

Robust petrol sales as diesel figures continue to fall

- In Q3 2025, petrol was the best-selling fuel type for the used market, with 1,145,148 transactions (a 1.9% YoY rise), while diesel transactions fell by 2.8% to 658,664.

- ICE cars accounted for 89.2% of used car transactions (down 2.5% YoY).

- 10.5% of used car sales in Q3 2025 were electrified (BEV, HEV, or PHEVs), marking a slight increase from Q2, when the combined total was 9.7%.

- Sales for the overall used car market rose by 2.8% from Q2, reaching 2,021,265 units, marking the best Q3 performance since 2021 – and an 11th quarter of continual growth.

New car market share by powertrain 2027-2018

| Year | BEV | HEV | PHEV | Petrol | Diesel |

|---|---|---|---|---|---|

| 2027* | 32.2% | 16.6% | 12.9% | 34.6% | 3.7% |

| 2026* | 28.2% | 15.4% | 12.1% | 40.0% | 4.3% |

| 2025* | 23.3% | 14.1% | 11.2% | 46.2% | 5.1% |

| 2024 | 19.6% | 13.4% | 8.6% | 52.2% | 6.3% |

| 2023 | 16.5% | 12.6% | 7.4% | 56.0% | 7.5% |

| 2022 | 16.6% | 11.6% | 6.3% | 55.9% | 9.6% |

| 2021 | 11.6% | 8.9% | 7.0% | 58.3% | 14.2% |

| 2020 | 6.6% | 6.7% | 4.1% | 62.7% | 19.8% |

| 2019 | 1.6% | 4.2% | 1.5% | 66.0% | 26.6% |

| 2018 | 0.7% | 3.4% | 1.9% | 62.3% | 31.7% |

*Forecast percentages taken from the SMMT’s October 2025 new car and van outlook.

Please note: The SMMT’s outlook was made during a subdued economic period but follows recent growth in the new car market. It was finalised before the Budget, which will be announced on 26 November 2025 - and may include further tax changes.

SMMT forecast for new car sales and market share by powertrain (2025-27)

2025

- The new car market is expected to grow 3% to 2,012,000 units (exceeding 2 million for the first time since 2019).

- BEV registrations are forecast to rise 22.8%, increasing market share to 23.3%.

- The PHEV market is expected to grow 35.4%, pushing market share to 11.2%.

- HEVs are forecast to grow 8.6% to reach a 14.1% share.

- The petrol market is expected to fall -8.8%, reducing market share to 46.2%.

- Finally, diesel registrations are projected to fall -15.8% to a 5.1% share.

2026

- In 2026, the new car market is expected to rise by 1% to 2,032,000 units.

- BEV market share is projected to reach 28.2%, with a 22.3% rise in transactions.

- The PHEV market is expected to grow 8.4%, with market share reaching 12.1%.

- HEV sales are forecast to grow 10.5%, reaching a 15.4% market share.

- Petrol registrations are predicted to fall -12.7% taking market share down to 40%.

- Finally, diesel sales are expected to decline by -15.8%, with market share falling to 4.3%.

2027

- The overall new car market is predicted to rise 1.3% to 2,058,000 units.

- BEV registrations are expected to rise 15.6%, pushing market share to 32.2%.

- PHEV registrations are projected to grow 8.3%, achieving a 12.9% market share – and HEVs by 9% to reach a 16.6% share.

- The petrol market is anticipated to fall -12.3%, with market share dropping to 34.6%.

- Finally, diesel is predicted to fall -13.8%, with market share dropping to just 3.7%.

webuyanycar’s head of technical services, Richard Evans said:

“The latest SMMT outlook shows BEVs are on track to account for almost a third of new car sales by 2027, underlining the rapid momentum of electrification in the UK.”

“HEVs and PHEVs are also expected to grow steadily, while petrol and diesel market share continues to shrink. With traditionally fuelled vehicles projected to fall below 35% by 2027, the coming years will be pivotal for the transition to electrified motoring.”

“Expanding the charging network, combined with Government and manufacturer incentives, will be essential to supporting this shift and encouraging more drivers to embrace EVs.”

How has the UK’s new EV market share grown over time?

- In 2016, BEVs accounted for just 1.4% of all new vehicle registrations.

- In 2024, BEVs secured a record 19.6% market share, and PHEVs made up a further 8.6% of registrations, bringing the total market share for plug-in vehicles to 28.2%.

- The number of annual BEV registrations grew over 10x from 36,907 in 2016 to 381,970 in 2024.

- The SMMT’s October 2025 forecast predicts 574,000 BEV registrations in 2026 – an increase of over 14x from 2016!

Resale values of used EVs

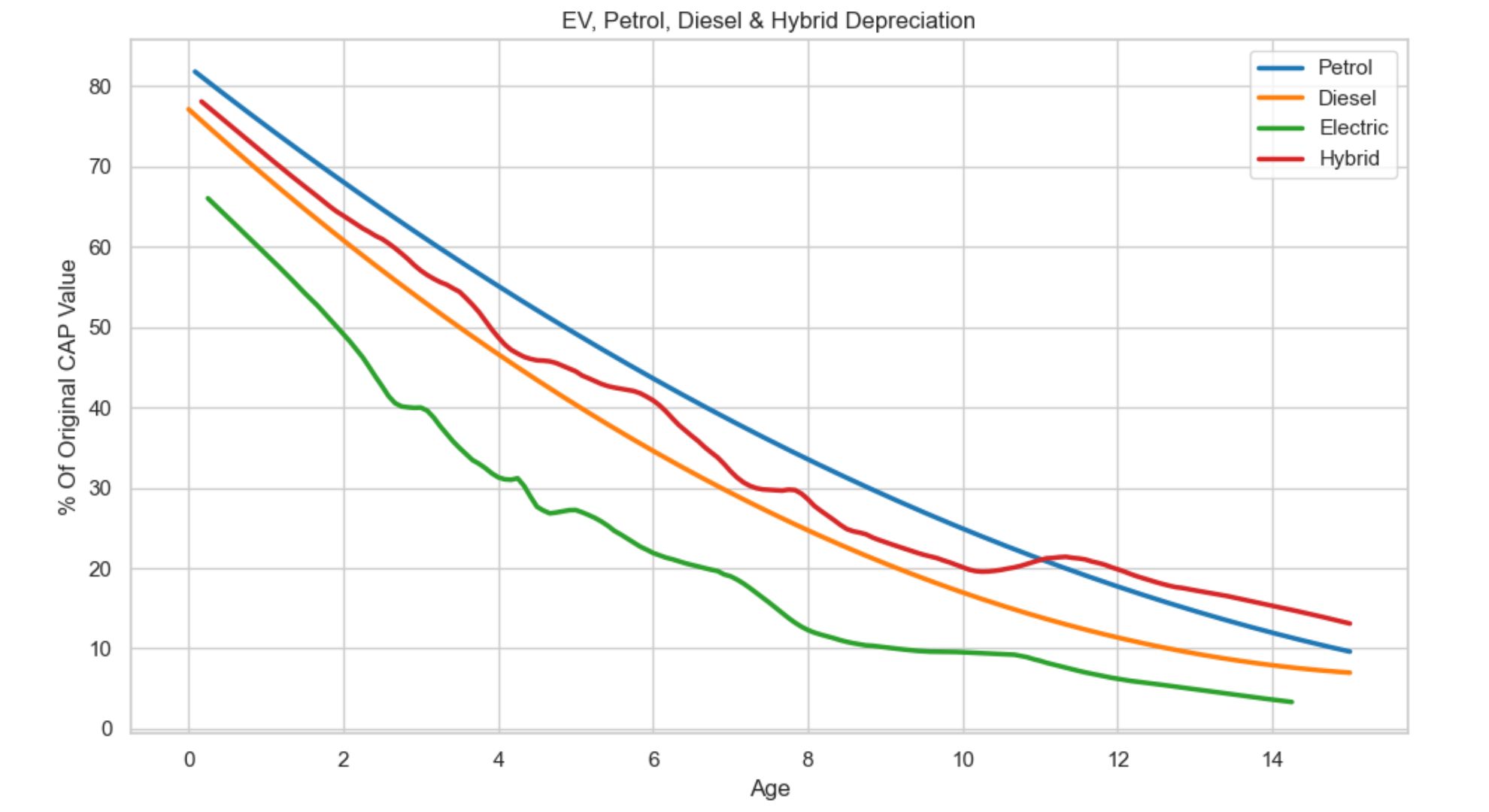

In August 2025, webuyanycar published new data about the average depreciation rates for EVs. This graph shows how the average EV’s depreciation curve compares to other powertrains:

*Disclaimer: Webuyanycar are not predicting future increases or decreases in your car’s market value. Changes in value can occur due to a variety of factors, including the vehicle’s age, mileage, condition, and the level of market demand. Learn more about what affects car value.

Source: webuyanycar

Key findings

- On average, EVs lose approximately 40% of their value after one year and around 50% after two years.

- Petrol, diesel, and hybrid cars retain over 65% of their value at one year and over 60% at two years.

- EVs consistently depreciate faster than other fuel types, with the gap gradually narrowing after the eight-year mark.

- EVs with strong brand reputations, better performance, and higher ranges tend to hold their value better than average.

How many BEVs are there in the UK?

As of the end of October 2025, there were over 1.7 million BEVs on the UK roads, representing over 5% of the UK’s 34 million car parc!

Source: Zapmap

EV chargepoint availability report

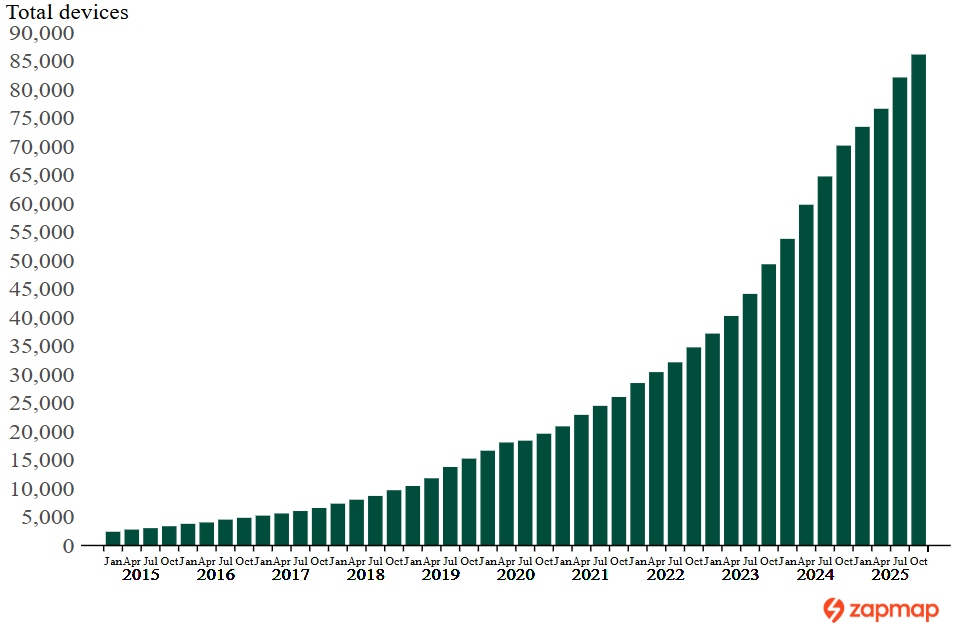

At the end of October 2025, there were 86,798 public EV chargepoints in the UK.

In October, 777 net new public charging devices were installed.

Source: Zapmap

Private charging

At the end of 2024, there were almost 1 million chargepoints installed at UK homes with driveways.*

*This figure has been adjusted for two-BEV households and does not include home chargers installed for the 380,000 new PHEV drivers from March 2022 to December 2024.

Research from data analytics consultancy, Field Dynamics showed that around 67.2% of the UK’s 28.4 million households (approximately 19 million) have access to a driveway or a dedicated parking space nearby.

The remaining 32.8% (equating to around 9 million households) lack access to private home parking, meaning they cannot use a private chargepoint.

Source: Zapmap, Field Dynamics

EV chargepoint growth trends 2020-2025

Source: Zapmap, GOV.UK

Between January 2020 and October 2025, the number of public EV charging devices in the UK grew from 16,505 to 86,798 – an increase of 426%.

The UK Government is currently on track to meet its target of 300,000 public EV chargers by 2030. There is currently ample public charging infrastructure to serve the UK’s 1.7 million EV parc.

Public charger speed: Shifting expectations

As EVs with increasingly faster charging capabilities have hit the market, expectations for public charging speeds have also risen, and steps are being taken to meet this demand.

As of October 2025, there are 17,734 Rapid or Ultra-rapid charging devices across 6,582 charging locations in the UK. Rapid chargers provide 50kW–149kW, while Ultra-rapid chargers offer 150kW+, in line with the Government’s Public Charge Point Regulations.

The network of Ultra-rapid chargepoints is expanding quickly, with 2,648 added since the start of 2025. 378 net new Rapid or Ultra-rapid chargers were installed in October alone.

Source: Zapmap

Leading EV chargepoint providers

- At the end of the October 2025, Shell Recharge Ubitricity had the most public chargepoints, with 11,716 devices, accounting for 13.4% of the UK’s public charger network.

- Connected Kerb and Pod were the next largest providers with 6,726 (7.7%) and 5,161 devices (5.9%) respectively.

Source: Zapmap

EV battery innovations

Toyota solid state tech could achieve 40-year battery lifespan

Toyota’s upcoming solid‑state battery claims a 40‑year lifespan, retaining around 90% capacity after that time. It promises faster charging, lighter weight, and improved safety over the current lithium‑ion packs.

Tesla’s ‘Tera-Cell’ could redefine EV range and charging

Tesla’s ‘Tera‑Cell’ battery aims for a 600+ miles range and an 80% charge under 15 minutes. Boasting 40% higher energy density, it could transform how EVs (and even flying cars) handle range and charging.

Huawei solid-state battery could unlock 1,800+ mile range

- Huawei’s solid‑state battery technology could deliver up to 1,860-miles and a full recharge in five minutes. This is made possible by a nitrogen‑doped sulfide electrolyte delivering 400–500 Wh/kg. However, some commercialisation challenges remain.

Different types of EVs

Here is a quick explainer on the various types of EV on the market:

Battery Electric Vehicles (BEVs)

Unlike the other hybrid variants on the market, BEVs are powered solely by an electric battery. Most BEVs have electric ranges between 100-300 miles.

(Whilst 200 miles or above is broadly considered a good range, a range of 100 miles may be sufficient depending on your daily commute.)

Plug-in Hybrid Electric Vehicles (PHEVs)

PHEVs combine a petrol or diesel engine with a smaller electric battery, typically offering 15-40 miles of electric range.

Some premium models provide longer ranges, such as the Toyota RAV4 PHEV (46 miles), BMW 2 Series 225e (56 miles), Mercedes GLE 350de (66 miles), and Polestar 1 (93 miles). Like BEVs, PHEVs can be plugged in to recharge their batteries.

Mild hybrid electric vehicles (MHEVs)

A mild hybrid electric vehicle (MHEV) combines a combustion engine with a small electric battery that assists the engine but cannot power the car alone.

It doesn’t need charging, as braking recovers energy to the battery. MHEVs improve fuel efficiency slightly over conventional cars but are more expensive to run than other electrified vehicles.

Fuel cell electric vehicles (FCEVs)

Fuel cell electric vehicles (FCEVs) use hydrogen to generate electricity, emitting only water vapour. They refuel in about five minutes and offer 300-400 miles of range but are less efficient than battery EVs, converting only 40-60% of fuel energy.

High costs and limited charging infrastructure have hindered growth, with just 300 FCEVs on UK roads and 15 hydrogen refuelling stations in the UK (with around six open to the public).

How do EVs work?

EVs are powered by one or more electric motors rather than an ICE engine. These motors are powered by a rechargeable battery, which can be replenished by plugging the vehicle into an electric charger.

What factors affect EV performance?

Your real-world electric range may differ from the advertised figure (which often reflects a best-case scenario). Factors that affect EV performance include your driving style, weather conditions - and the degree to which features such as the in-car heating and air conditioning are used.

Smart energy recovery technology

EVs utilise technology that converts kinetic energy into electricity whilst braking or travelling uphill, automatically topping up the battery.