UK Car Market Statistics: Used and New Car Sales in Q4 2025 and Q1 2026

Published February 13, 2026

- In Q4 2025, 1,769,501 used cars changed hands in the UK (a +1.3% YoY increase), continuing moderate growth at the end of the year.

- In 2025, a total of 7,807,872 used cars were sold in the UK (a +2.2% YoY increase), marking three consecutive years of market growth.

- Black was the most popular used car colour (21.2%), followed by grey (18.2%), and white (16.0%). Together, they accounted for over half (55.4%) of all used sales.

Our quarterly UK car market statistics guide provides the latest insights for automotive journalists, industry insiders, and informed consumers.

In this edition, we'll cover the best-selling car types and models, sales by powertrain (new and used), and the incentives and challenges shaping the UK's used and new car - and EV markets.

Get a free valuation

Car market glossary

YoY = Year-on-year

YTD = Year-to-date

MoM = Month-on-month

Powertrain = The system responsible for generating a vehicles power - and transferring it to the road.

EV = Electric vehicle

BEV = Battery electric vehicle

PHEV = Plug-in hybrid electric vehicle

MHEV = Mild hybrid electric vehicle

ICE = Internal combustion engine

SMMT = Society of Motor Manufacturers and Traders

2025 UK used car market analysis

| Month | 2025 | 2024 | YoY change |

|---|---|---|---|

| Jan | 659,682 | 650,747 | +1.37% |

| Feb | 651,783 | 653,484 | -0.26% |

| Mar | 709,525 | 663,692 | +6.91% |

| Apr | 672,145 | 669,281 | +0.43% |

| May | 689,196 | 672,657 | +2.46% |

| Jun | 634,775 | 621,457 | +2.14% |

| Jul | 693,512 | 668,890 | +3.68% |

| Aug | 678,945 | 669,243 | +1.45% |

| Sep | 648,808 | 627,678 | +3.37% |

| Oct | 674,801 | 669,319 | +0.82% |

| Nov | 606,182 | 607,483 | -0.21% |

| Dec | 488,518 | 469,249 | +4.11% |

| Total | 7,807,872 | 7,643,180 | +2.15% |

Source: SMMT

Breakdown by powertrain

| Fuel type | 2025 | 2024 | YoY change |

|---|---|---|---|

| Petrol | 4,430,901 | 4,367,009 | +1.5% |

| Diesel | 2,586,279 | 2,674,725 | -3.3% |

| HEV | 407,531 | 306,114 | +33.1% |

| BEV | 274,815 | 188,382 | +45.9% |

| PHEV | 88,032 | 92,120 | -4.4% |

Source: SMMT

Used car trends

- In 2025, 7,807,872 used cars changed hands (a +2.15% YoY increase), compared with 7,643,180 transactions in 2024.

- Q1 delivered solid momentum, with March up +6.91% YoY to 709,525 transactions, the strongest monthly uplift of the year.

- Performance remained broadly stable through the summer, with July up +3.68% YoY and September rising +3.37% YoY, reflecting steady demand.

- The year ended on a positive note, with December up +4.11% YoY to 488,518 transactions.

- Petrol remained the dominant fuel type in 2025, with 4,430,901 transactions (a +1.5% YoY increase), representing 56.7% of used sales.

- Diesel volumes fell -3.3% YoY to 2,586,279 units (33.1%), continuing their structural contraction.

- Electrified vehicles saw the strongest growth rates.

- HEV volumes rose +33.1% YoY to 407,531 transactions.

- BEVs increased +45.9% YoY to 274,815, the fastest growth of any fuel type.

- However, PHEVs declined -4.4% YoY to 88,032 transactions.

webuyanycar's head of technical services, Richard Evans said:

“The data shows the UK's used car market has moved beyond recovery and into structural stability. At 7.81 million transactions, volumes are now in line with long-term norms, supported by improved supply and more predictable seasonal trading.”

“Petrol continues to anchor the market with mass-appeal, while diesel's gradual decline reflects constrained new supply and shifting consumer sentiment.”

“Electrified vehicles are expanding significantly faster than the wider market. Robust growth in hybrids and BEVs points to improving affordability, greater availability in the three-to-five-year age bracket and rising buyer confidence. Softer PHEV volumes indicate some consumers are opting for either full hybrid or fully electric rather than transitional technologies.”

“However, industry commentary suggests the pace of transition remains finely balanced. Ongoing debate around the ZEV mandate and manufacturer compliance costs highlights the pressure facing the new car market, particularly as the sector works towards phasing out new petrol and diesel car sales by 2030 and hybrids by 2035.”

“As industry bodies have noted, sustaining consumer demand, maintaining affordability and ensuring charging infrastructure keeps pace will be critical to delivering that transition in a stable and commercially viable way.”

Best-selling used cars 2025 vs 2024

| Best-selling models 2025 | Transactions | Best-selling models 2024 | Transactions |

|---|---|---|---|

| Ford Fiesta | 303,090 | Ford Fiesta | 306,207 |

| Vauxhall Corsa | 247,853 | Vauxhall Corsa | 252,761 |

| Volkswagen Golf | 226,082 | Volkswagen Golf | 231,440 |

| Ford Focus | 218,962 | Ford Focus | 228,220 |

| BMW 3 Series | 157,343 | MINI | 160,516 |

| MINI | 154,527 | Vauxhall Astra | 159,495 |

| Volkswagen Polo | 153,583 | BMW 3 Series | 158,674 |

| Vauxhall Astra | 149,410 | Volkswagen Polo | 151,786 |

| Nissan Qashqai | 145,207 | Nissan Qashqai | 138,810 |

| Audi A3 | 125,752 | BMW 1 Series | 125,440 |

Source: SMMT

Top 4 stability continues

The Ford Fiesta (303,090), Vauxhall Corsa (247,853), Volkswagen Golf (226,082) and Ford Focus (218,962) remained the four best-selling used cars in 2025.

However, all four recorded YoY declines compared with 2024:

- Ford Fiesta: −1.0%

- Vauxhall Corsa: −1.9%

- Volkswagen Golf: −2.3%

- Ford Focus: −4.1%

This suggests that while the traditional supermini and lower-medium hatchback staples still anchor the market, their dominance is gradually softening as buyers diversify into other body styles and segments.

Mid-table reshuffle signals shifting demand

- The BMW 3 Series (157,343) moved ahead of the MINI, reflecting resilience in the premium saloon segment (-0.8% YoY vs. MINI's -3.7%).

- The Volkswagen Polo (+1.2% YoY) was one of the few top 10 models to grow YoY.

- The Nissan Qashqai (+4.6% YoY) strengthened its position, rising from 138,810 to 145,207 transactions.

- The Audi A3 (125,752) entered the 2025 top 10, replacing the BMW 1 Series.

Most popular used car types in 2025

- Superminis remained the dominant category, representing almost one in three used transactions (around 32.1%).

- Lower medium cars (traditional compact hatchbacks and small family cars) followed, making up the second-largest share of the market at approximately 26.9%.

- Dual purpose vehicles (DPVs) grew strongly, with the segment achieving the most significant percentage increase among the major categories, accounting for around 16.8% of transactions, reflecting an appetite for higher-riding, SUV-style models.

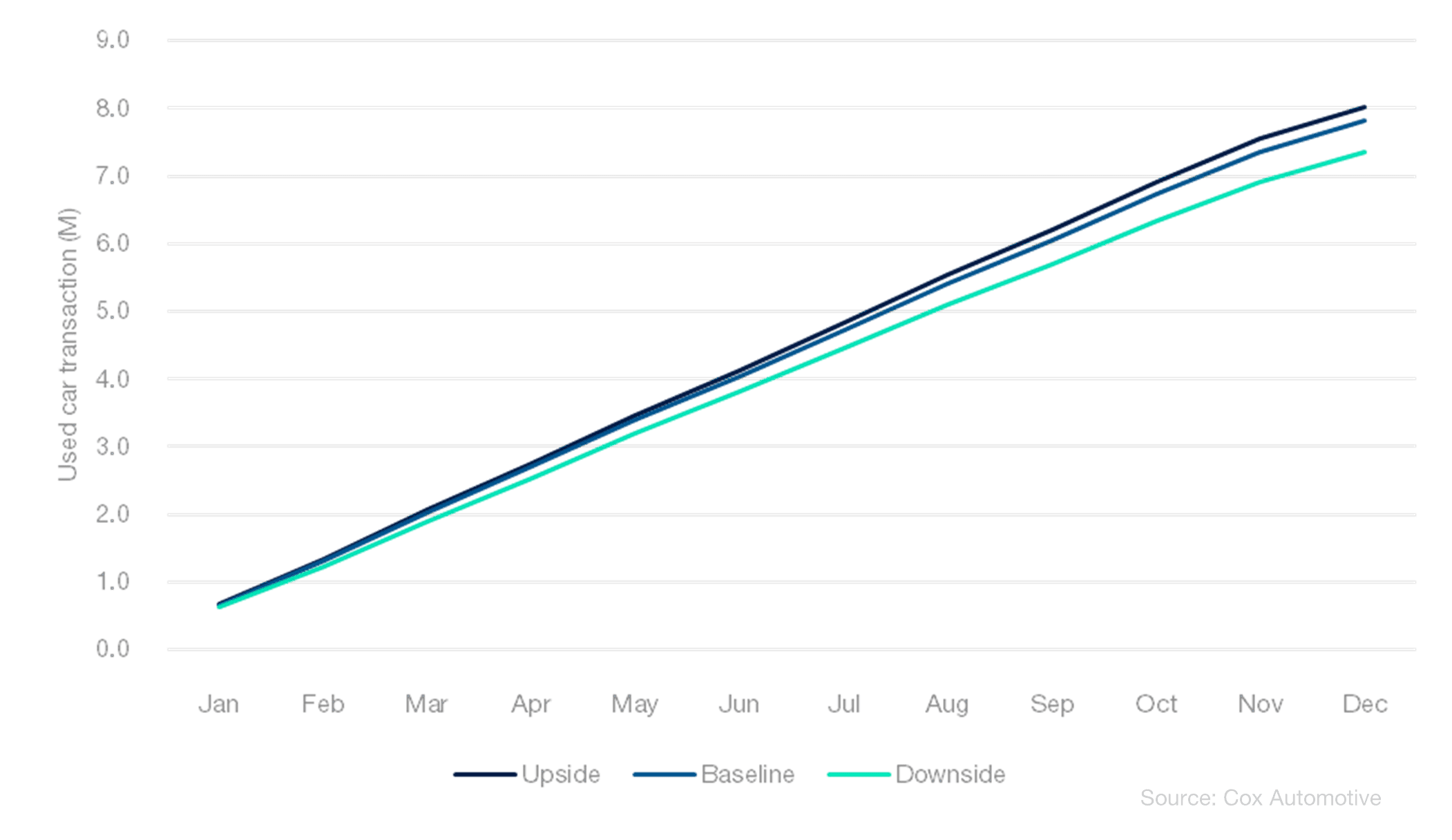

Used car market predictions for 2026

The latest Cox Automotive Q4 2025 forecast outlines three scenarios for the UK used car market in 2026:

| Scenario | 2026 projected volume | YoY change vs 2025 |

|---|---|---|

| Upside | ~8.03 million | +2.9% |

| Baseline | ~7.83 million | +0.3% |

| Downside | ~7.36 million | −5.7% |

Key forecast takeaways

- Market stability expected: The baseline forecast suggests the used car market will hold near 2025's volume (~7.8 m), indicating resilience as supply constraints ease further.

- Potential for modest growth: In a more optimistic environment (e.g. improving credit conditions and consumer demand), used transactions could exceed 8 million in 2026, a feat last achieved in 2017.

- Downside risk remains: A more challenging macro backdrop could see volumes decline below 7.4 million, particularly if affordability pressures intensify.

New car market statistics: January 2026

| Powertrain | Jan 2026 | Jan 2025 | % change | Market share '26 | Market share '25 |

|---|---|---|---|---|---|

| BEV | 29,654 | 29,634 | +0.1% | 20.6% | 21.3% |

| HEV | 19,297 | 18,413 | +4.8% | 13.4% | 13.2% |

| PHEV | 18,557 | 12,598 | +47.3% | 12.9% | 9.0% |

| Petrol | 68,757 | 70,075 | -1.9% | 47.7% | 50.3% |

| Diesel | 7,862 | 8,625 | -8.8% | 5.5% | 6.2% |

| Total | 144,127 | 139,345 | +3.4% |

Powertrain trends

- PHEVs saw the strongest growth in January (+47.3% YoY), increasing market share from 9.0% to 12.9%.

- HEVs also posted steady gains (+4.8%), reflecting continued demand for lower-emission alternatives.

- BEVs remained broadly stable (+0.1%), though share dipped slightly from 21.3% to 20.6%.

- Petrol registrations declined by -1.9%, but still account for nearly half of all new registrations (47.7%).

- Diesel fell -8.8%, continuing its long-term downward trajectory in the new car market.

Overall, January's +3.4% market growth was largely supported by electrified powertrains, particularly PHEVs and HEVs.

The gap between fleet and private demand

| Jan 2026 | Jan 2025 | % change | Market share '26 | Market share '25 | |

|---|---|---|---|---|---|

| Private | 52,397 | 50,133 | +4.5% | 36.4% | 36.0% |

| Fleet | 88,269 | 86,849 | +1.6% | 61.2% | 62.3% |

| Business | 3,461 | 2,363 | +46.5% | 2.4% | 1.7% |

| Total | 144,127 | 139,345 | +3.4% |

Source: SMMT

The UK's new car market grew +3.4% YoY in January 2026, with 144,127 registrations recorded across all sales channels (up from 139,345 in January 2025).

- Private registrations increased +4.5% YoY, lifting market share to 36.4% (up from 36.0% in January 2025).

- Fleet demand also edged higher, rising 1.6% YoY, although its market share eased slightly to 61.2%, down from 62.3% a year earlier.

- Business registrations surged 46.5% YoY, increasing market share to 2.4%, compared with 1.7% last January.

Best-selling new car models (2023-2025)

| 2025 | Registrations | 2024 | Registrations | 2023 | Registrations |

|---|---|---|---|---|---|

| Ford Puma | 55,488 | Ford Puma | 48,340 | Ford Puma | 49,591 |

| Kia Sportage | 47,788 | Kia Sportage | 47,163 | Nissan Qashqai | 43,321 |

| Nissan Qashqai | 41,141 | Nissan Qashqai | 34,454 | Vauxhall Corsa | 40,816 |

| Vauxhall Corsa | 35,947 | Nissan Juke | 34,454 | Kia Sportage | 36,135 |

| Nissan Juke | 34,773 | Tesla Model Y | 32,862 | Tesla Model Y | 35,899 |

| Volkswagen Golf | 32,478 | Volkswagen Golf | 32,370 | Hyundai Tucson | 34,469 |

| Volvo XC40 | 30,404 | Hyundai Tucson | 32,174 | MINI | 33,385 |

| MG HS | 30,191 | MG HS | 30,207 | Nissan Juke | 31,745 |

| Volkswagen Tiguan | 29,857 | Volvo XC40 | 30,207 | Audi A3 | 30,159 |

| Hyundai Tucson | 28,613 | Volkswagen Polo | 28,981 | Vauxhall Mokka | 29,984 |

Source: SMMT

webuyanycar's head of technical services, Richard Evans said:

“The SMMT's data confirms that the UK's new car market has structurally shifted towards compact and mid-sized SUVs. The Ford Puma, Kia Sportage, and Nissan Qashqai continue to anchor the top of the table, underlining sustained demand for high-riding, family-oriented vehicles that balance practicality, efficiency, and perceived value.”

“Traditional superminis and hatchbacks remain relevant, with models such as the Vauxhall Corsa and Volkswagen Golf still featuring prominently, but they are no longer setting the pace.”

“Another clear development is the normalisation of electrified models within the top 10 sellers. The presence of Tesla and MG alongside established European and Korean brands signals that EVs and hybrid SUVs are no longer niche disruptors but strong competitors in the mainstream market.”

“Overall, the trend is less about volatility between individual nameplates and more about format dominance: SUVs now define the core of the UK's volume market, while traditional body styles compete within a narrower, value-driven space.”

How many cars are there in the UK?

According to DVLA data, as of September 2025, there were approximately 34,486,000 licenced cars on UK roads.

UK new car sales statistics (2027-2011)

| Year | Number of registrations |

|---|---|

| 2027 | 2,084,000* |

| 2026 | 2,048,000* |

| 2025 | 2,020,520 |

| 2024 | 1,952,778 |

| 2023 | 1,903,054 |

| 2022 | 1,614,063 |

| 2021 | 1,647,181 |

| 2020 | 1,632,064 |

| 2019 | 2,311,140 |

| 2018 | 2,367,147 |

| 2017 | 2,540,617 |

| 2016 | 2,692,786 |

| 2015 | 2,633,503 |

| 2014 | 2,476,435 |

| 2013 | 2,264,737 |

| 2012 | 2,044,609 |

| 2011 | 1,941,253 |

*Figures taken from the SMMT's January 2026 Outlook forecast.