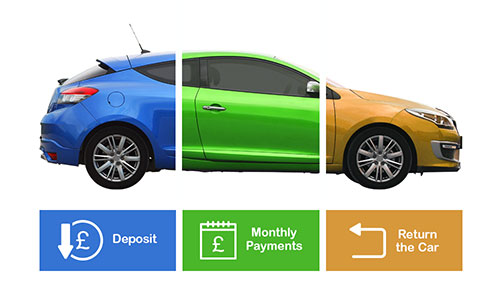

A Personal Contract Hire (PCH) plan allows you to lease a vehicle long term (typically over 2-4 years), then return the car to the leasing company once the contract ends.

With a PCH plan, you’ll make an initial payment (usually equivalent to 3-12 monthly payments) followed by regular monthly payments for the duration of the contract.

Get a free valuation

Can you buy a car through a PCH plan?

Unlike with other car finance options such as Personal Contract Purchase (PCP), you cannot buy a car at the end of a PCH agreement. However, PCH deals usually have lower monthly payments, as you’re merely paying to rent the vehicle.

If you want to finance a car with a view to buying it, it’s worth considering a PCP or Hire Purchase (HP) plan. Our free car finance calculator tool can help you work out your monthly costs.

How does PCH car leasing work? (step-by-step)

-

Find a suitable PCH deal

Consider which make or model of car you would like to lease with a PCH deal. Set some time aside to explore car leasing comparison websites and evaluate the available options.

When making your decision, think about how much you can comfortably afford to pay each month – and set a limit for the initial payment.

-

Credit check

When you request a PCH deal from a car leasing company, they will conduct a credit check to ensure your eligibility.

However, credit checks for PCH deals are often less stringent than for other car finance options such as PCP and HP agreements.

-

Make your initial payment

The initial payment for a PCH deal goes towards the total cost of your lease and reduces your monthly payments.

Most providers will offer some flexibility for the initial payment, allowing you to choose an amount that suits your financial circumstances. Just bear in mind that the larger your initial payment, the smaller your regular monthly instalments will be.

The initial payment for a PCH agreement is often equivalent to 3-12 monthly payments.

-

Make your regular monthly payments

After making your initial payment, you’ll make regular monthly payments for the remainder of the agreement. You can choose the duration of your PCH agreement at the start of the process. Most providers tend to offer 24, 36 or 48-month contracts.

-

Return the car

Once your PCH agreement comes to an end, you’ll need to return the car to the leasing company. Although you won’t be able to buy the vehicle outright, you may be able to extend the term of the contract. However, this is at the company’s discretion.

You’ll be expected to return the car in good condition, with all the original documents. You will be liable for any missing documents or damage beyond normal wear and tear.

Advantages of PCH

-

Lower monthly payments: A PCH deal could be a great option if you’re looking to keep your monthly payments low.

-

Drive a new car for less: If you want to drive a new car but aren’t concerned about owning it, leasing through a PCH deal could be an attractive option.

-

Enjoy the latest technology: Newer cars are loaded with the latest tech and safety features that older models lack, such as Android Auto/Apple Car Play, lane keep assist, automatic emergency braking, keyless entry and adaptive headlights.

-

No need for MOTs: If you lease a new car over a term of less than 36 months, you won’t have to worry about MOT tests.

-

Simple and straightforward: Leasing a car through a PCH deal is simple and easy to understand. Just make your initial payment, then keep up with your regular monthly payments for the remainder of the contract.

-

No hidden costs: Servicing and maintenance costs are included with many PCH plans, so you won’t be hit with unexpected garage bills.

-

Road tax and warranty included: Many PCH deals also include road tax and a manufacturer warranty, so there’s even less to worry about.

-

No depreciation worries: If your car’s value depreciates faster than anticipated over the term of the agreement, you won’t be subject to any financial penalties.

Disadvantages of PCH

-

No option to own the car: Unlike with a PCP deal, once you reach the end of a PCH agreement, you cannot buy the car. So, once the contract ends, you’ll have to look for a new motor.

-

Mileage restrictions: A PCH deal typically comes with a mileage limit. If you exceed this limit, you will be liable for an extra charge covering the excess mileage at the end of the contract.

-

Few options for leasing used cars: PCH deals are usually offered with new cars. Used PCH deals are relatively rare and may be costly.

-

Difficult to leave: Before committing to a PCH deal, ensure that you’re happy to make the payments over the agreed duration. Terminating a PCH contract early can be difficult and costly. So, if there’s a possibility that you might want to leave mid-contract, you should consider a different car financing option.

-

Liable for damage: PCH contracts have stringent rules around wear and damage. When you hand a car back to a leasing company, they will thoroughly inspect the vehicle for damage. If the damage found exceeds normal wear and tear, you will be liable to pay for the repair costs.

-

No modifications allowed: You cannot modify a leased car, as you are not the legal owner.

Is a PCH plan right for you?

A PCH deal could be a smart choice if:

-

You don’t want to worry about depreciation or selling your car.

-

You’re keen on driving a new car but aren’t fixated on owning one.

-

You’d like to change cars every few years.

-

You’re confident about staying within the terms of a lease, including adhering to mileage limits and keeping the car in good condition.

What happens at the end of a Personal Contract Hire agreement?

-

At the end of a PCH agreement, you’ll be expected to hand the vehicle back to the leasing company.

-

Unlike with a PCP contract, there is no option to make a balloon payment and purchase the car.

-

The leasing company may allow you to extend the contract, but this is at their discretion.

-

You’ll have to pay the excess mileage charge (if applicable).

-

The leasing company will inspect the car - and if it is deemed to be damaged beyond regular wear and tear, you will be liable for any repair costs.

-

If you have your heart set on keeping the car, you might be able to come to an arrangement with the company, but this won’t always be possible.

Frequently Asked Questions

Yes, it is often possible to secure a PCH deal, even with bad credit, but you may have to pay a higher rate of interest. However, if your credit rating is very poor, you may have more success taking the HP route, as this gives the lender more security.

Terminating a PCH agreement early can be difficult, not to mention expensive. In some cases, you might even have to pay off the remaining cost of the lease in full! The leasing company may be more receptive to the idea of switching your lease to another vehicle, but this is by no means guaranteed.

If you are struggling to make your monthly payments, you should contact the leasing company promptly; they may be able to adjust your contract to make the payments more manageable.

They may agree to extend the length of your lease to reduce your monthly payments. However, in some cases, the leasing company may take the car back.

When financing a car through a HP agreement, you’ll usually pay a deposit (typically at least 10% of the car’s value), then pay off the remainder in a series of monthly instalments, with the loan secured against the car.

The duration of a HP agreement is often between 12 and 60 months. Unlike with a PCH lease, once you have made the final payment on a HP agreement, you will own the car.

With a PCP agreement, you make an initial deposit, followed by monthly payments throughout the duration of the contract.

Then, at the end of the contract, you have the option to make a balloon payment – a lump sum that enables you to buy the car.

A balloon payment is based on the Minimum Guaranteed Future Value (MGFV) - a figure determined by the lender at the start of the contract representing what they expect the car to be worth at the end. This figure is not changeable and if your car is worth more than the MGFV at the end of the term, you’ll be in positive equity, meaning you’ll have extra cash to put towards your next car purchase.

As they come with the option to buy the car at the end, monthly payments for a PCP plan are usually higher than for a PCH lease.

According to research from the Finance and Leasing Association, around 80% of people who finance a car through a PCP agreement choose not to buy it when their contract ends. If you aren’t set on buying the car at the end of your contract, a PCH agreement will probably be the most cost-effective option.